affirm: Can BNPL Be Better?

When Affirm was founded in 2012, the world of consumer finance wasn’t exactly known for innovation. Credit cards ruled the market, and the average American carried a revolving balance with interest rates that seemed to rise as easily as they were overlooked. But for Max Levchin, co-founder of PayPal and a key figure in Silicon Valley, the opportunity wasn’t just to build another financial service but to reimagine how consumers could borrow without falling into the usual traps.

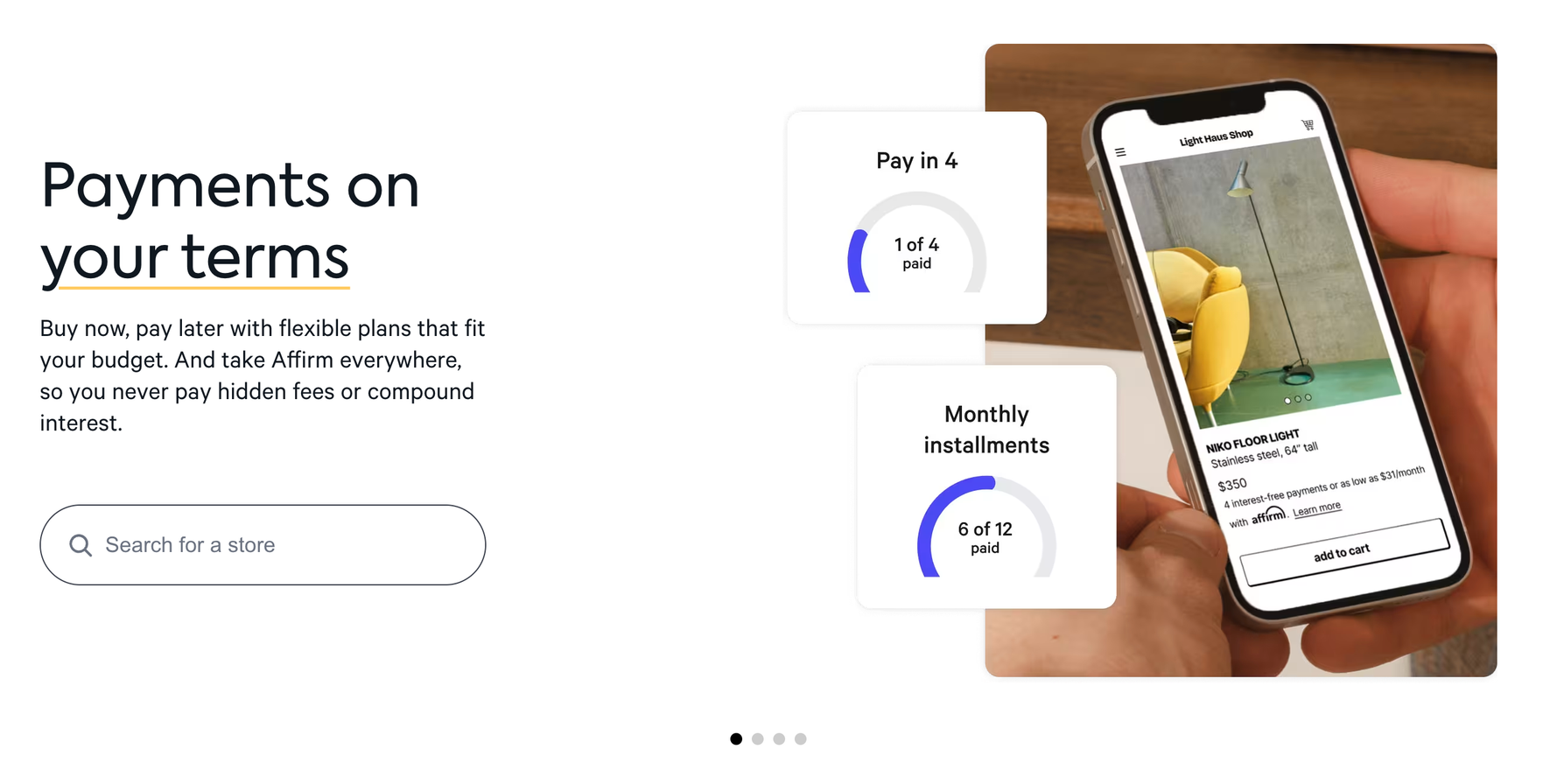

Affirm didn’t enter the scene with a flashy product or viral campaign. It entered with a simple proposition: what if consumers could buy something now and pay for it later with full transparency, no compounding interest, and no hidden fees? While the idea of “buy now, pay later” (BNPL) wasn’t new—retailers had offered layaway for decades—Affirm’s approach wrapped that model in sleek fintech packaging and infused it with modern data science.

Levchin’s pitch was rooted in ethics as much as opportunity. After seeing the dark side of traditional lending models, he envisioned Affirm as the opposite of opaque. At its core, the platform offered short-term installment loans at the point of sale. Customers could see exactly how much they’d owe upfront, select a fixed repayment schedule, and walk away with a product and a plan without any of the financial smoke and mirrors often associated with credit.

Affirm started quietly but gained momentum by partnering with online merchants who wanted to give their customers more flexible payment options. Early relationships with brands like Peloton proved pivotal. As customers looked for ways to finance high-ticket purchases, Affirm’s simple interface and friendly tone made it feel less like a loan and more like a convenience.

But behind the user-friendly checkout buttons was a sophisticated backend. Affirm analyzed thousands of data points to assess a borrower’s creditworthiness in real-time. Instead of relying solely on traditional credit scores, the company incorporated alternative signals. This gave Affirm an edge, allowing it to approve customers that legacy lenders might overlook, while managing risk at scale.

Data Points

One of the core ways Affirm differentiated itself in the BNPL space was through its use of alternative data points for underwriting. Unlike traditional lenders that rely heavily on FICO scores (a type of credit score that lenders use to assess a person’s creditworthiness), Affirm integrated additional data such as a borrower’s purchase behavior, repayment history with Affirm, and even the price and type of product being financed. This broader dataset allowed Affirm to assess risk more dynamically and offer financing to consumers who might have been overlooked by conventional credit systems. It also helped the company better tailor loan terms—like repayment timelines and interest rates—based on individual financial behavior rather than one-size-fits-all scoring. This data-driven underwriting was key to Affirm’s ability to scale responsibly while maintaining transparency and customer trust.

As e-commerce surged in the mid-2010s, so did Affirm. Its model spread across verticals: from fashion and fitness to electronics and furniture. Merchants appreciated the conversion lift, and consumers welcomed an alternative to credit cards. By 2019, Affirm had processed billions in loans and was partnering with hundreds of retailers, embedding itself seamlessly into the online shopping experience.

But Affirm didn’t just stay in the background. It leaned into branding, aiming to build trust in a category that historically inspired anything but. Its clean aesthetic, plain-language policies, and straightforward marketing helped position it as a friendly disruptor in a space crowded with skepticism. In a world where fine print ruled, Affirm made clarity a value proposition.

Still, scale brought scrutiny. As Affirm’s visibility grew, so did concerns about the broader BNPL industry. Critics warned that easy access to financing could lead consumers into overspending. Unlike traditional credit cards, BNPL loans didn’t always appear on credit reports, making it harder for consumers to track their total debt load. Regulators began paying closer attention, and consumer watchdogs started raising questions about whether the simplicity of BNPL might mask its financial consequences.

Affirm’s answer wasn’t to retreat; it was to double down on transparency. The company launched new tools to help consumers better understand their repayment plans, offered more educational content, and added features like automatic payments and budgeting integrations. Levchin and his team argued that if given the right tools, consumers would behave responsibly, and that BNPL, when done right, was a healthier form of credit than revolving debt with sky-high interest.

In 2021, Affirm went public in one of the most anticipated fintech IPOs of the decade. The company opened at a valuation of over $23 billion, riding a wave of investor optimism about the future of digital finance. At the time, Affirm was one of the most recognizable names in the BNPL space, competing with companies like Afterpay, Klarna, and Zip, while also carving out a unique brand identity focused on integrity and tech-first innovation.

Going public brought both resources and pressure. Affirm expanded its product offerings by introducing a virtual card for online purchases, launching a savings account to diversify its revenue, and developing partnerships with giants like Amazon. These moves signaled an ambition to move beyond BNPL into a full-fledged financial ecosystem. But as with any public company, the pressure to meet growth expectations became more intense.

As macroeconomic conditions shifted—especially in the post-pandemic inflation wave—consumer spending behaviors changed. Investors began questioning the sustainability of BNPL models in a high-interest environment. Affirm’s stock price fluctuated, and analysts debated whether the company could maintain its momentum amid tightening credit and rising delinquency risks. Yet despite these challenges, Affirm continued to iterate and lean into responsible lending, expand its merchant network, and invest in fraud protection and underwriting improvements.

At the same time, Affirm also raises important questions about the ethics of consumer finance. Does making it easier to pay later help or hurt consumers in the long run? Is transparency enough if it encourages spending beyond one’s means? Should companies be held responsible for how their tools are used—or just for offering clear terms?

Affirm doesn’t shy away from these conversations. It positions itself as part of the answer and has consistently voiced support for regulation in the BNPL space, insisting that oversight can level the playing field and protect consumers. While some competitors fought regulation, Affirm leaned into it, betting that its transparent model would hold up under scrutiny.

Transpareny

Affirm response by making transparency a core part of its brand identity. As competitors faced backlash for hidden fees, confusing terms, or encouraging irresponsible spending, Affirm positioned itself differently by promising no late fees, no compounding interest, and clear payment schedules shown upfront before any purchase was made.

This approach wasn’t just ethical—it was strategic. By making the true cost of borrowing obvious, Affirm built trust with both consumers and regulators. In an industry under growing scrutiny, their commitment to clarity became a competitive moat.

That kind of posture is part of what makes Affirm stand out. It’s not just a lender; it’s a brand trying to build a new relationship between people and credit. And while the business is not without risks or controversy, it’s clear that Affirm has pushed the conversation forward—making finance not just more accessible, but more understandable.

Affirm may be leading the charge in making BNPL more transparent and responsible—but the model itself still raises big questions. As more players flood the market and consumers grow more comfortable splitting everyday purchases into installments, the line between accessibility and overextension becomes blurrier. Affirm’s mission-driven approach offers a more thoughtful path forward, but the question remains: can the BNPL industry as a whole grow without encouraging the very habits players like affirm are trying to reform?

Works Cited

- “Affirm Holdings, Inc.” Wikipedia, 2025. Includes founding year (2012), founders, user and merchant stats, business model overview, underwriting, and product portfolio .

- “Max Levchin and Building Truly Honest Finance Products” by PYMNTS, 2017. Discusses Levchin’s mission for transparent, honest point-of-sale credit .

- “Affirm Announces Pricing of Initial Public Offering” (Press Release). Details number of shares, IPO timing, and pricing .

- “Underwrite or Lose (Money)!” by Affirm Investors News. Describes Affirm’s real-time underwriting and data usage .

- “Affirm Surges to a $1.2B IPO Bringing Its Valuation to $23B+” by Built In SF, January 2021. Covers IPO valuation and strong stock performance .

- “Max Levchin on Transparency & No Late Fees” by Tearsheet, 2025. Highlights Affirm’s emphasis on clarity, zero late fees, and trust building .

- “How Does Affirm Make Money? Dissecting Its Business Model” by ProductMint, ~2022. Explains revenue streams, interest rates, and underwriting drivers .

- “Affirm IPO Highlights Rapid Growth of ‘Buy Now, Pay Later’ Industry” by Crunchbase News. Covers IPO funding and investor base .

- “Affirm: Transforming Modern Payments” by LifeSelfMastery, 2025. Outlines CEO vision and Affirm’s mission in modern finance .